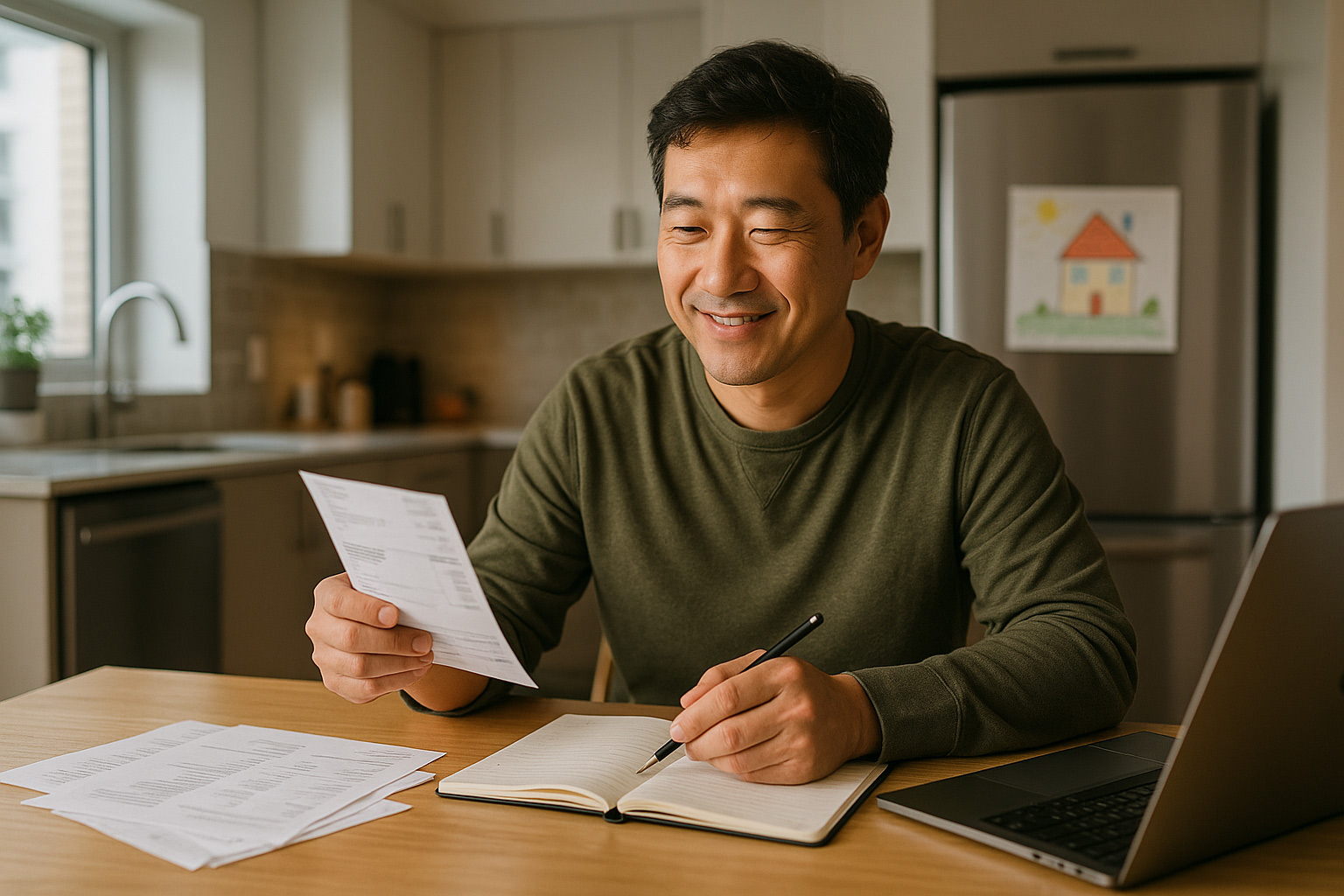

Building a Strong Foundation for You and Your Family

Financial stress and housing instability can make fatherhood feel heavier than it already is. The goal isn’t to be perfect with money or to have the “ideal” home—it’s to take steady steps toward stability so your children feel safe, provided for, and secure.

These tips are designed to help fathers strengthen their financial footing and protect their families’ housing, one decision at a time.

Financial Strength Strategies

Create a monthly budget and track every dollar.

Write down what comes in and what goes out. Even a simple list on your phone or a notebook helps you see where your money is really going.

Prioritize needs before wants.

Focus first on rent, utilities, food, transportation, and child-related expenses. Once those are covered, then consider extras.

Save something each paycheck.

Even $5 or $10 every time you get paid builds the habit. Over time, these small amounts can become an emergency cushion.

Seek financial coaching or job-readiness programs.

Look for community organizations, workforce centers, or fatherhood programs that help with résumés, interview skills, and money management.

Understand your child support rights and obligations.

Knowing how child support works—what you owe, what’s flexible, and how to modify orders if your income changes—can prevent surprises and reduce stress.

Housing Guidance

Keep important documents together.

Store your ID, birth certificates, Social Security cards, and pay stubs in one safe place (a folder, envelope, or small lockbox). You’ll need these when applying for housing or assistance.

Reach out for help early.

If you’re worried about rent, utilities, or losing your housing, call 211 or local housing services as soon as possible. The earlier you ask, the more options you may have.

Explore assistance programs.

Look into rental assistance, utility support, and emergency shelter options. These programs exist to keep families housed and safe.

Have a backup plan.

Think ahead about where you could stay for a night or two in an emergency (trusted family, friends, or shelters) while you work on a long-term solution.

Securing Long-Term Stability

Get on housing lists as early as possible.

Connect with local housing authorities and apply for waiting lists, even if you’re currently housed. Openings can come up unexpectedly, and being on a list puts you in line for future opportunities.

Learn about mediation services.

Some communities offer landlord–tenant mediation to resolve problems before they turn into evictions. Asking for help early can protect your record and your family’s stability.

Build positive relationships in the community.

Neighbors, mentors, faith communities, and local organizations can be sources of support, information, and safety when life gets hard.

Keep records of everything.

Save rent receipts, emails, texts, and letters related to your housing. If a dispute comes up, having a record of payments and conversations can help protect you.

Look into credit-building and homebuyer programs.

Many nonprofits and banks offer first-time homebuyer classes and credit-building tools. Even if owning a home feels far away, learning now sets you up for future possibilities.

If you’re facing eviction, act quickly.

Contact legal aid or tenant-rights organizations as soon as you receive a notice. Support is often available before court dates—and acting early can make a big difference.

Final Reminder

Financial strength and stable housing are not just about money or walls—they’re about peace, safety, and hope for your family.

Every step you take—tracking your spending, asking for help, saving a few dollars, keeping documents organized—is a step toward stability. You don’t have to do it all at once, and you don’t have to do it alone.

Strong foundations help fathers stand tall. And when fathers stand tall, families stand stronger.